[WHITEPAPER]

More than 99% of Bitcoin remains idle, disconnected from the rapidly growing DeFi ecosystem worth $231 billion.

This isn't due to a lack of interest. It's due to a lack of trust.

Every existing solution requires trusting committees, operators, or custodians.

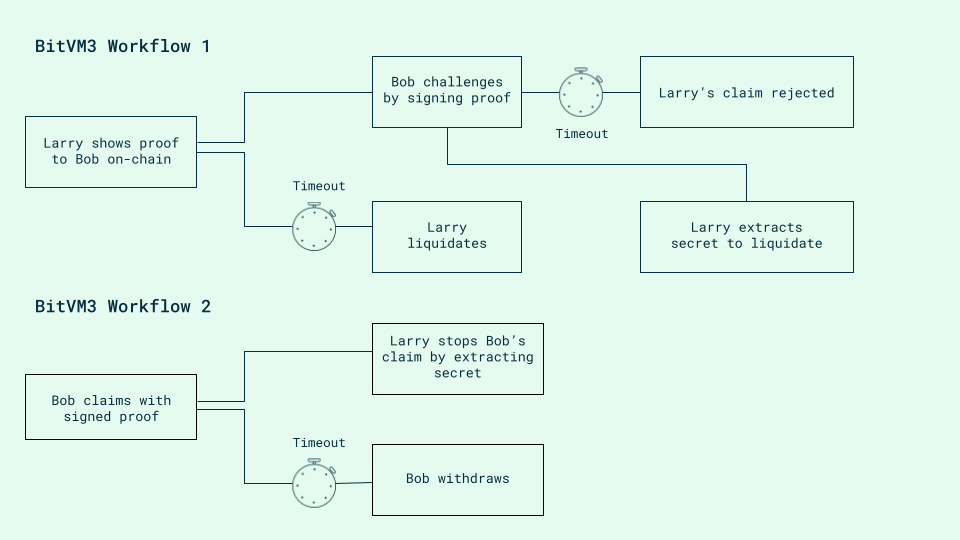

The magic happens through BitVM3 technology.

Either party must provide a valid zero-knowledge proof to withdraw Bitcoin. Invalid proofs trigger secret revelation through garbled circuits. The secret will open a hash lock, which prevents the fraudulent withdrawal.

No trusted third parties required.

The cost improvement is dramatic.

Our experiments on BitVM2 and BitVM3 show that on-chain costs in the unhappy path can be reduced from $15,700 (BitVM2) to $93.

That translates into a 170x reduction in the collateral needed for each deposit.

In the happy path, only 3 Bitcoin transactions are needed, costing less than $1 each.

Do you get it yet?

This enable major DeFi applications:

• Lending: Native BTC as collateral without wrapped tokens

• Stablecoins: BTC-backed USD tokens with trustless liquidation

• Perpetuals: Bitcoin margin trading

among others. All while maintaining self-custody.

Security comparison matters so here's one:

Traditional approaches require trusting covenant committees, bridge operators, or signer committees.

Trustless vaults eliminate all external trust dependencies. Only the vault participants control redemption.

This represents Bitcoin's evolution from static store of value to programmable foundation for DeFi.

And we're not even changing Bitcoin's protocol.

We're just unleashing its existing capabilities through cryptography.

Sixteen years after Satoshi introduced trustless digital money, we're finally integrating that original seed with the smart contract economy.

In other words, this is huge.

7.11K

44

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.