Although I cleared all my $DOT tokens in May, I still pay attention to the opportunities in its ecosystem.

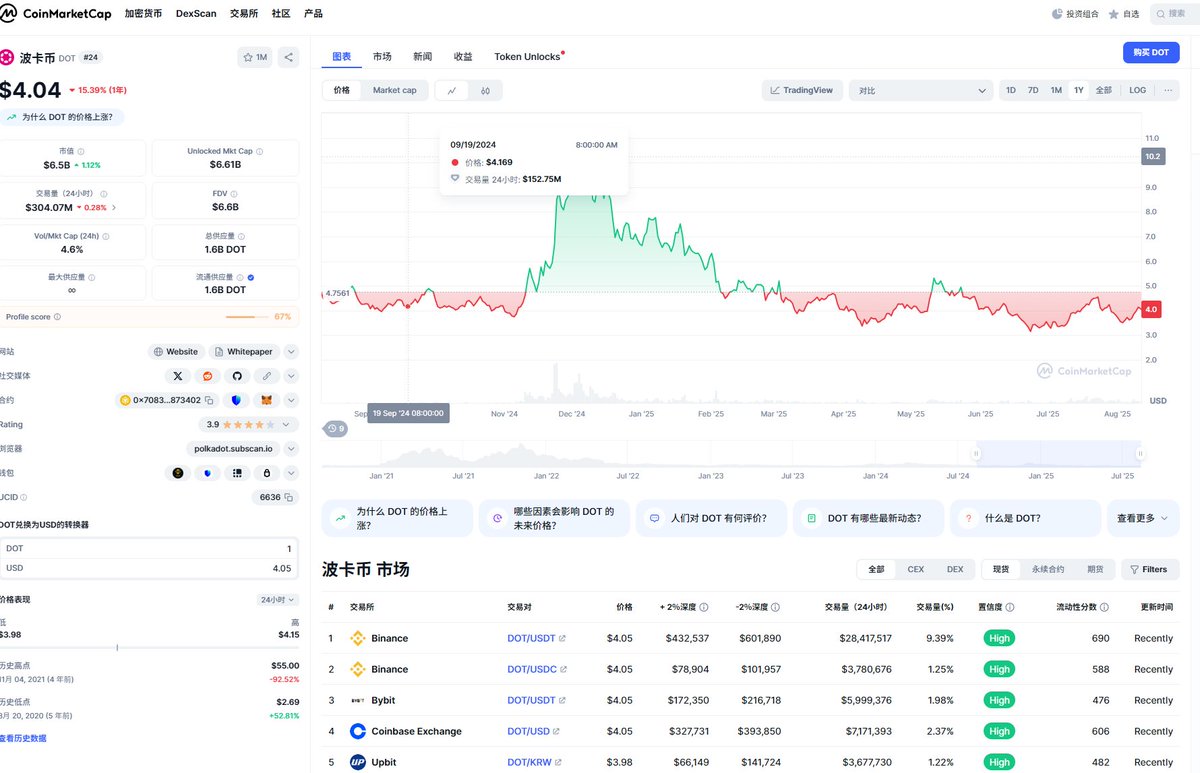

As a truly top-tier project, it used to rank in the top ten by market cap for many years, but now it has fallen to twenty-fourth, surpassed by $uni, $ton, and others, with a market cap of only 6.6 billion USD.

Speaking of Polkadot, many newcomers to the space may not be familiar with it. The founder, @gavofyork, is a co-founder of ETH, and he completed the main technology of ETH, as well as being the author of the Solidity language. All contracts on the EVM are written in this programming language, making him one of the most prominent figures in the crypto space.

Here are a few major reasons why I am paying attention again:

1. Unified Address Format

Like its competitor @cosmos, I think the biggest problem with @Polkadot is the lack of a unified address format. The ecosystem addresses are extremely chaotic, and the wallets are not user-friendly, which increases the learning cost for users.

After missing the DeFi explosion in 2021 and 2022, it wasn't until November 2024, when Referendum #1217 was passed, that it was officially decided to unify the address format.

In the future, all parachains will use the SS58 prefix 0, with addresses starting with 1. Existing parachains will gradually adopt the new format through #runtime upgrades.

2. ETF Approval

After the approval of BTC and ETH ETFs, the sharp rise in coin prices gave me confidence, and the approval of the #DOT ETF is also approaching. The SEC has determined after three years of review that #DOT is software and not a security.

Originally scheduled for June 11, the ETF decision has been postponed to November 8, and recently the SEC's attitude towards crypto has become unusually mild.

Once the ETF is approved, I believe DOT will be a good target, as it is a token with a market cap of only 6 billion USD, which has tremendous growth potential.

3. Technical Advantages

Although layer 2 has developed significantly over the years, with TPS already very high, DOT, as a native cross-chain heterogeneous sharding chain, is inherently more secure, and the ceiling for TPS will also be very high.

However, the current valuation of TPS is not high, so this is not my main reason for investing at the moment.

Finally, let me share my investment strategy:

I plan to accumulate positions on dips soon, with the best entry point being below 3.5 USD, keeping it for staking on the mainnet or earning interest on exchanges.

Before the ETF approval, I will allocate a certain position. Once the ETF is approved, I can consider increasing my holdings.

Show original

26.29K

16

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.