The stock market looks at intrinsic value, but cash and risk assets are discounted differently, Bitcoin has only seen a slight discount in history, but will ETH be significantly discounted?

It depends on two things:

First, whether the amount of funds that continue to buy can be withstood

The second is whether the consensus brought about by the rise can be stable

Any coin cannot rely on the bookmaker's deadlift, whether it is MEME or other coins. At that time, $BCH pulled much stronger than today's ETH, directly jumping to half of BTC's market capitalization.

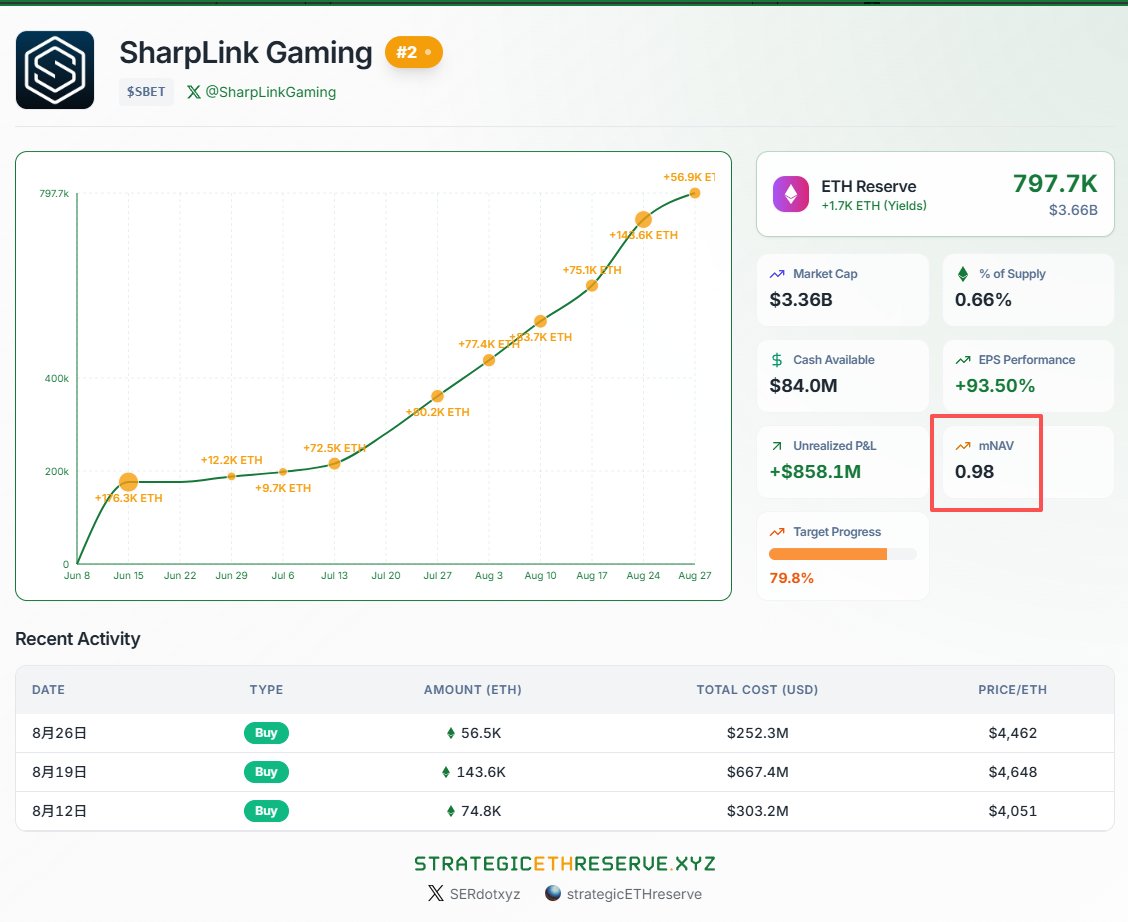

SharpLink's (SBET) mNAV has dropped to 0.98

This means that the value of Ethereum held by it has exceeded its stock price.

Tell me my opinion:

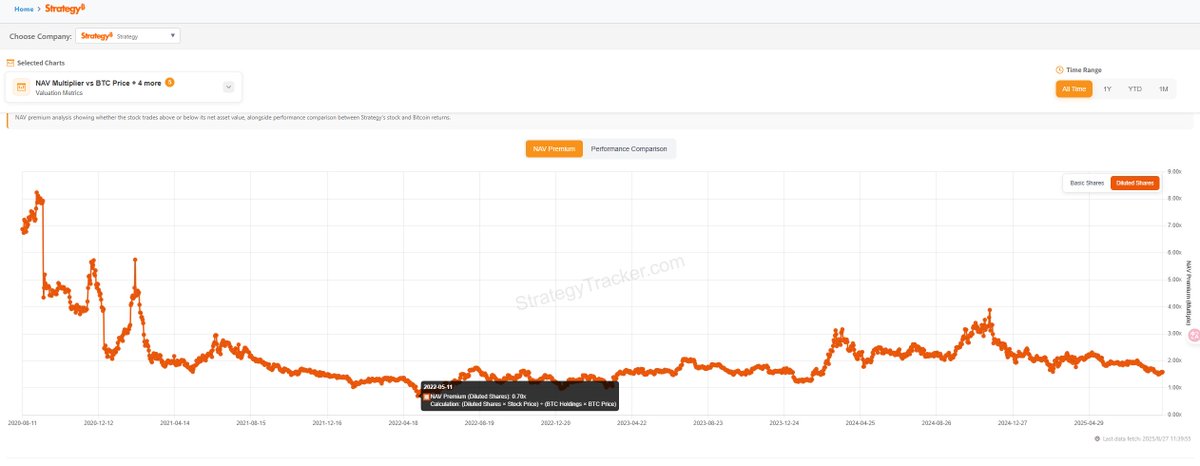

1. Taking history as a lesson, Weice's mNAV fell to a minimum of 0.7 that year, but that was the super bottom of the super bear market, and the price of Bitcoin was about 2w in May-June 22.

2. WeCe≥ 95% of the time, the mNAV is ≥1, and it falls below to be short-term.

3. Some people compare DAT and Grayscale's GBTC side by side, but there is an essential difference between the two: Grayscale was unable to redeem assets *under regulatory requirements*, resulting in de-anchoring; In the DAT treasury strategy, listed companies have complete autonomy, and the secondary market is free to adjust positions, making it difficult to de-anchor for a long time.

The above are non-financial advice.

113.43K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.