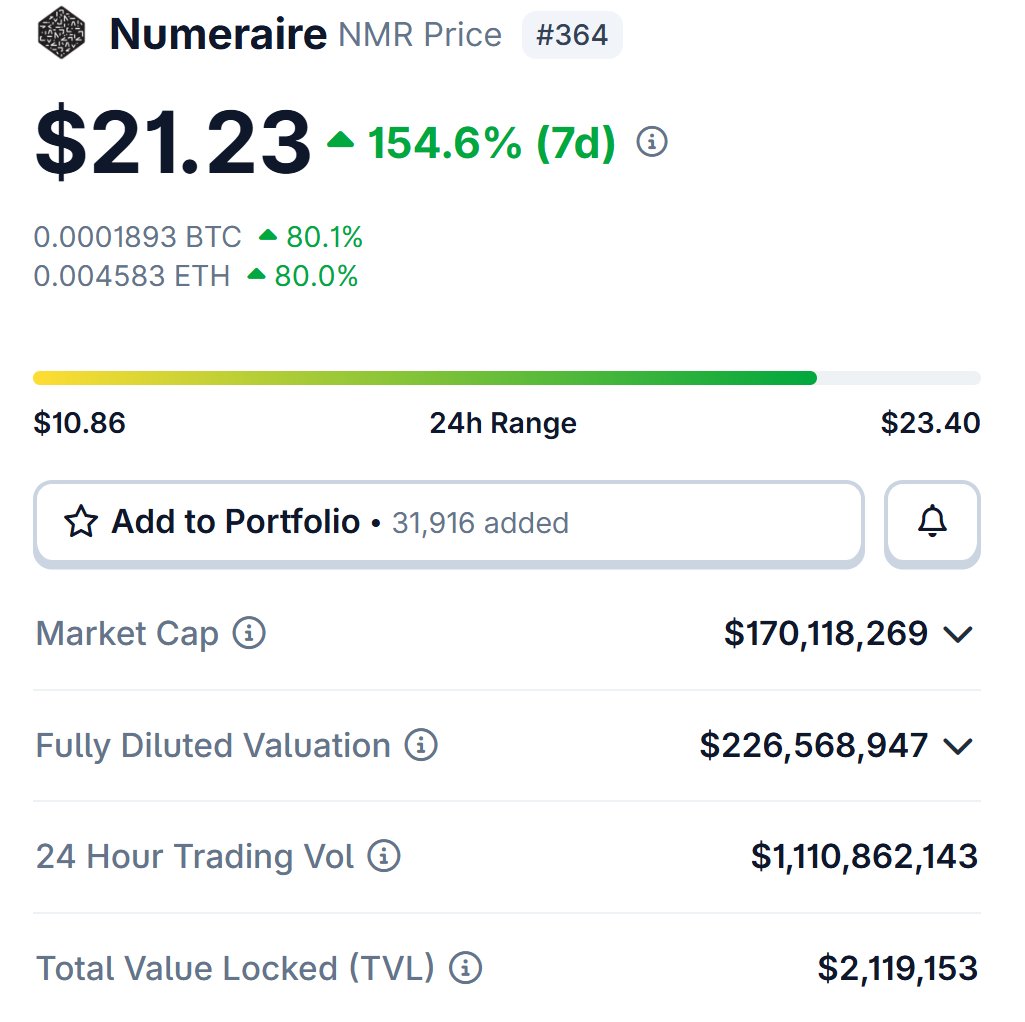

$NMR is catching 10X the volume compared to its market cap, and most of you don’t even know what’s behind this tech titan!

It's one of the OG “real use case” projects that’s been quietly building since 2017.

Here’s the story 👇

Back in 2015, @richardcraib saw hedge funds struggling. Models were closed, data was secret, and results weren’t as sharp as they could be.

So he flipped the model: instead of one fund relying on a few analysts, he built Numerai, a hedge fund powered by thousands of data scientists worldwide.

Numerai gives scientists scrambled data so they can build models without bias.

But in 2017, $NMR was launched and now they can stake on their models; good ones earn, bad ones burn.

Fast forward:

✅ Hedge fund AUM grew from $60M → $450M

✅ Net return in 2024 was +25.45% (solid vs trad hedge funds)

✅ Over $7M worth of NMR is currently staked by data scientists

✅ Numerai just secured $500M capacity from JPMorgan to scale operations

✅ Team even repurchased $1M NMR recently

No surprise NMR pumped 125% in the last 7 days.

So why is it unique?

It’s one of the few tokens directly tied to real hedge fund performance

Supply is capped (11M max, with burns reducing it further)

Every week, there’s actual demand from data scientists staking to prove their models

It has both tradfi cred (JPMorgan backing) and crypto-native mechanics (staking, burning, tournaments)

What’s next?

If Numerai continues to scale AUM and outperform traditional funds, demand for NMR staking will only grow.

Add in the token buybacks + burns, and you’ve got a rare combo of utility, scarcity, and real-world adoption.

I don't know why this combo of AI + finance + crypto incentives is still trading below 200M.

Show original

36.21K

149

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.