RWA on @zksync Era has been growing really fast. But what is @tradable_xyz that makes up almost 90% of it?

[Overview]

Tradable is a platform where institutions can tokenize and manage yield-generating institutional-grade assets on-chain while staying compliant.

As of Aug 11 2025 it has tokenized around $2.4B in assets across 35 investment products. These live on zkSync Era and about 90% of zkSync Era’s RWA TVL comes from Tradable.

[Tokenization Process]

When Tradable tokenizes investments it skips intermediaries like SPVs and directly tokenizes the underlying loan assets. Here’s how it works when an institution lists a deal and investors join in:

1. Pre-registered institutions called originators list a new deal with details like investment terms and capital requirements. An ERC20 contract is deployed for the deal and originators can set rules on who can invest based on factors like country, investor type, or AML/KYC status. If the criteria aren’t met the token can’t be traded or transferred.

2. Investors review the deal and submit an offer.

3. The originator reviews and either accepts, rejects, or proposes new terms.

4. If accepted, the investor confirms and signs a binding electronic agreement.

5. The investor sends funds in stablecoins or via bank transfer. Once confirmed, they receive tokens representing their ownership.

6. If the deal pays interest, it’s either distributed automatically in USDC via smart contract or in fiat through the originator to the investor’s bank account.

7. When the deal matures, the originator repays the principal and the corresponding tokens are burned.

[Major Deals]

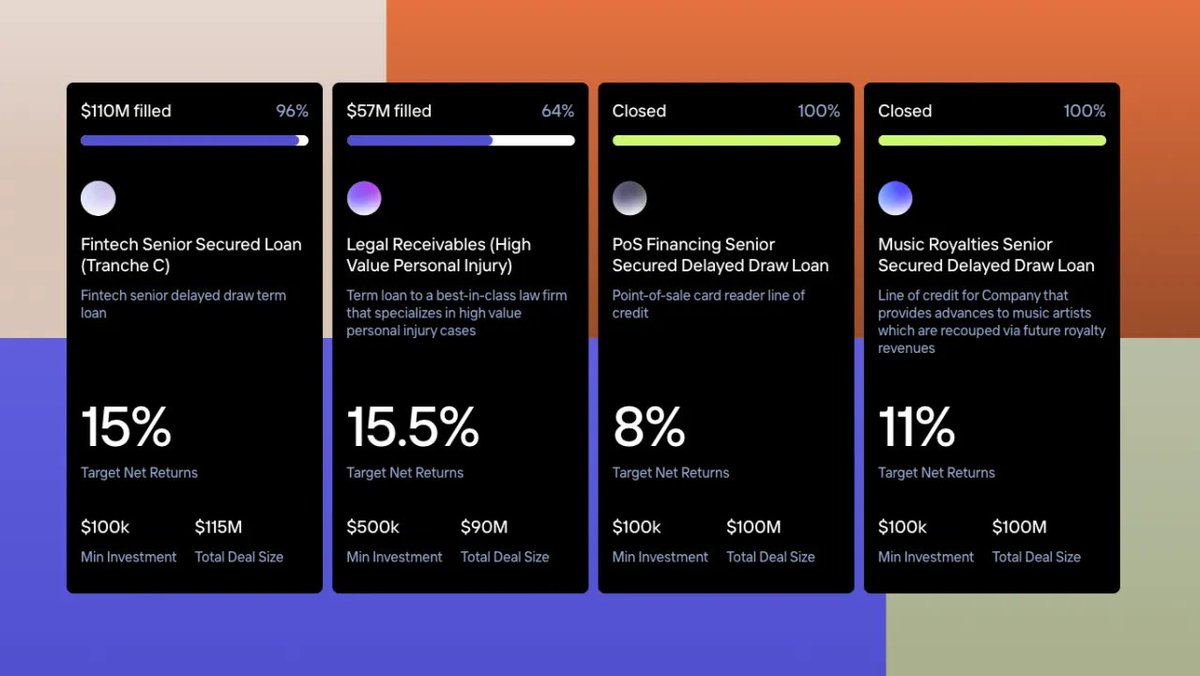

Tradable supports a wide range of tokenized investment products, but most deals right now are in private credit — typically offering high yields in the 7–20% range. Here are some examples:

▪️US Buy Now, Pay Later Finance Provider Senior Secured Term Notes: Bonds from a company offering BNPL-based POS and digital payment services in the US, Australia, New Zealand, and Canada.

▪️North America Rent Financing Platform Senior Secured Term Notes: Bonds backed by a loan portfolio from a US-based rent financing platform.

▪️Gov’t Contractor Financier Senior Secured Term Notes: Bonds for SMEs providing services under US federal government contracts.

▪️LatAm Fintech Senior Secured Term Notes: Bonds backed by a loan portfolio serving mid- to low-credit consumers in Mexico with short-term microloans.

▪️Singapore Fintech Senior Secured Loan: Bonds backed by loans from a Singapore-based fintech offering BNPL, e-commerce installment plans, and small personal loans.

[Final Thoughts]

The one downside? Even though Tradable has tokenized a variety of bonds on zkSync Era, their trading and use cases are still pretty limited. To fix this, Tradable has a roadmap to launch a secondary market that will allow private credit tokens to be traded more freely in the future.

Show original

2.25K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.