On Multi-Variate Lending Market Designs:

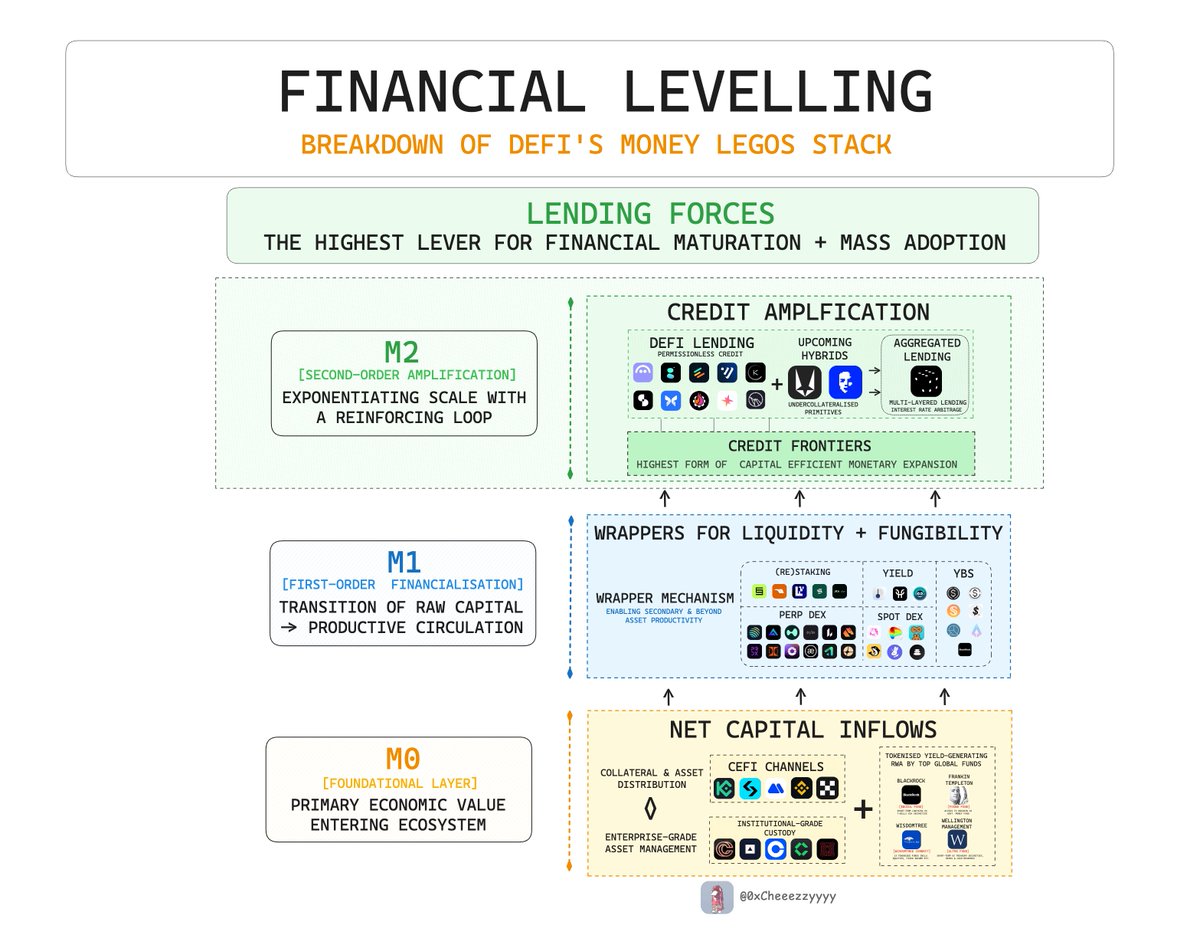

Lending markets are the most primitive & foundational cornerstone of monetary expansion: the 'M2 layer' in the onchain financial stack.

Their growth compounds through credit amplification which serves as the most effective unlock to monetary expansion → the next step towards the endgame to DeFi’s maturation.

And right now, we’re already in the stage of formalising this.

------

The Legacy Era: Origins of Credit Primitives

We'd came a long way ever since.

@aave @compoundfinance spearheaded P2E lending during DeFi Summer 2021, leaving a lasting legacy on DeFi’s design language.

Today, lending stands as DeFi’s largest sub-sector ($65.7B) → with @aave still unmatched in TVL dominance (50.2% at ~$33B), deeply trusted by institutions, funds & even reserves like @ethereumfndn.

In major ecosystems, the lending layer has matured into a self-sustaining cornerstone of the financial stack.

------

The Innovative Frontier: It Never Stops Baby

Maturity doesn’t equal stagnation.

We’ve seen fresh momentum with protocols like @MorphoLabs, introducing Optimizer (& now Earn V2) which pioneered smarter credit flows via dynamic P2P logic + precision-matched lending.

Then there’s @eulerfinance @Dolomite_io who are not first movers, but now undeniable contenders. Their traction proves that DeFi lending remains a wide-open, underexploited arena.

This wave was followed by the yield-maximizoor era, led by recursive borrowing loops → automated strategies designed to extract every last drop of yield.

Platforms like @GearboxProtocol @Contango_xyz @loopfixyz & even @CurveFinance began offering one-click leveraged strategies, complete with built-in, risk-adjusted params for both power users & passive farmers alike.

Together, these shifts reshaped lending from a passive yield-generating product to an active yield-strategy layer, serving as a core innovation frontier of DeFi.

------

Now, The Emerging Meta: Strategy-First Lending

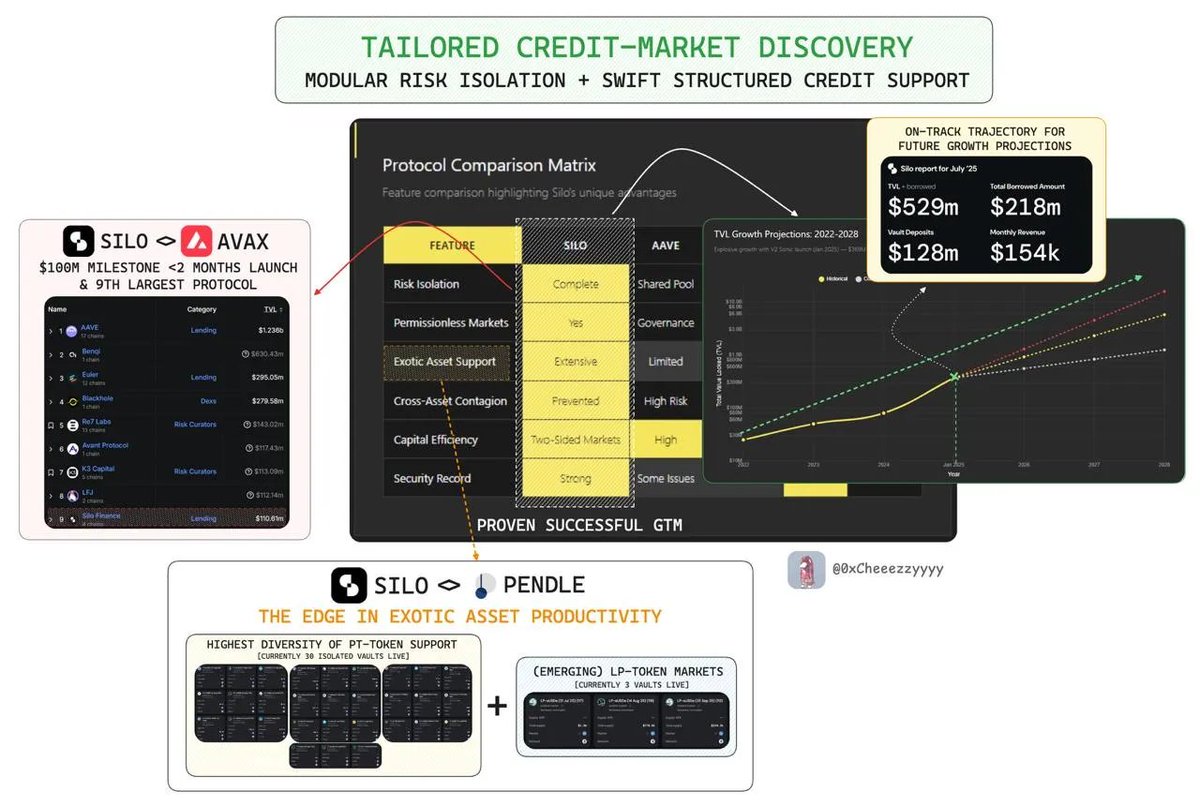

Today, the frontier has shifted toward multi-variate lending architectures: tailored for flexibility, precision & risk isolation.

From generalised one-size-fits-all → specialised one-of-its-kind.

We’re entering an era where curators and strategists craft more exotic, tailored & niche lending strategies for an increasingly ‘DeFi-savvy’ audience.

This is where @SiloFinance shines.

It’s built for:

🔸 Speed to market → rapid deployment

🔸 Tailored vaults → niche strategies with isolated risk

🔸 First-mover advantage → esp. in newly discovered yield opportunities

Think of it as the agile arm of DeFi lending that aims to bridge the ‘composability gap’ from a now-mature M1 layer (asset wrapper mechanisms i.e. stablecoins, LSTs, yield tokens).

The isolated design removes cross-asset contagion & instills confidence for scale.

The results speak for themselves:

🔹 $500M+ YTD TVL

🔹 Crossed $100M TVL on @avax in <2 months

🔹 Leading $300M TVL on @SonicLabs, standing toe-to-toe with Aave

------

On Adaptability & Diversification:

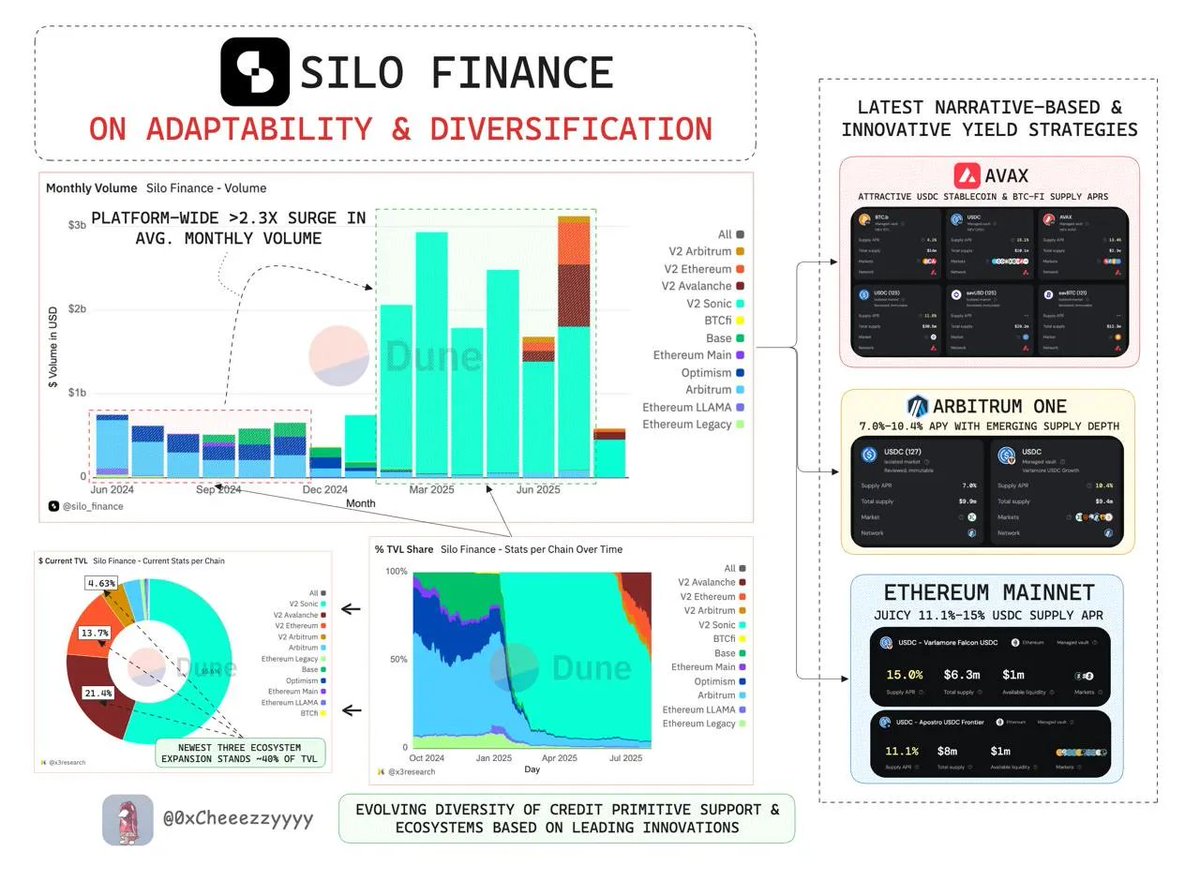

DeFi is entering a second-order evolution phase, and lending innovation is accelerating.

Silo’s winning edge lies in enabling maximum composability + capital agility to capitalise on emerging yield strategies fast.

This has been demonstrated by its rapid ecosystem penetration across mainnet, Arbitrum & Avalanche through delivering attractive & scalable opportunities.

Composable structured credit + modular risk isolation = outsized success

And with its GTM playbook maturing + footprint expanding, its only getting started.

You're not ready.

Super Silo

h/t @Dune @DefiLlama for the data insights.

lastly, tagging frens chads & DeFi enjoyoors who might appreciate this piece on lending:

@thelearningpill

@kenodnb

@ahboyash

@cryptorinweb3

@eli5_defi

@Jonasoeth

@YashasEdu

@St1t3h

@arndxt_xo

@crypto_linn

@Mars_DeFi

@CipherResearchx

@belizardd

@Slappjakke

@HarisEbrat

@Nick_Researcher

@Flowslikeosmo

@TheDeFinvestor

@the_smart_ape

@SiloIntern

@JiraiyaReal

@web3_alina

@_SmokinTed

@_thespacebyte

12.11K

83

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.