Understanding the Momentum Vault

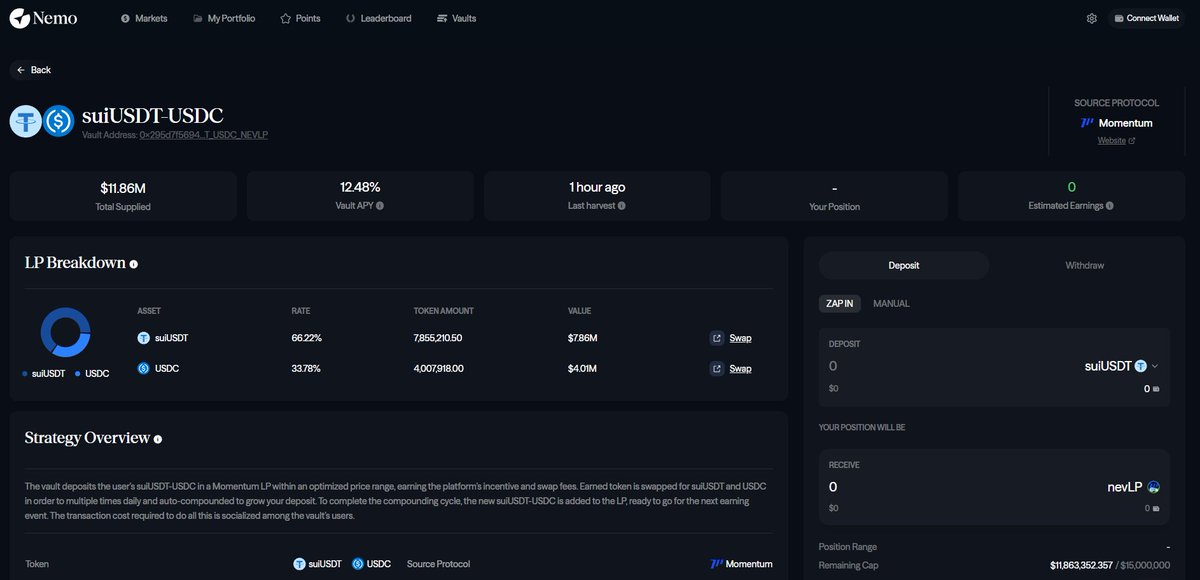

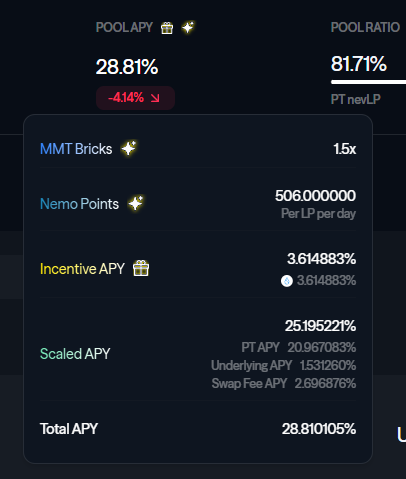

@MMTFinance has a feature called Vault. At first glance, it seems similar to just providing liquidity, and indeed, if you look at the APR, it appears similar to regular liquidity provision as well.

So what is the difference? In the case of the Momentum Vault, it is not operated by Momentum. It is managed by another service that creates a vault using Momentum's LP.

The biggest difference is that if you directly invest funds into LP, you have to set the Range and make adjustments, but this Vault, while it puts funds into the same liquidity pool, automatically makes adjustments and claims interest automatically to increase it.

The principle behind this is that it has the advantage of not having to manage the Range separately and instead optimizes it for management. Additionally, since it is a large pool, the fees are shared among all depositors, which means it doesn't cost much.

The Vault will take a fee on the profits, but the advantage is that there is no need for direct management.

Moreover, not only can you mine MMT Bricks, but if you use it on Nemo, you can also accumulate Nemo Points simultaneously, allowing for double farming. Of course, since there is exposure to two smart contracts, you must consider the risks associated with the smart contracts of both Nemo and Momentum.

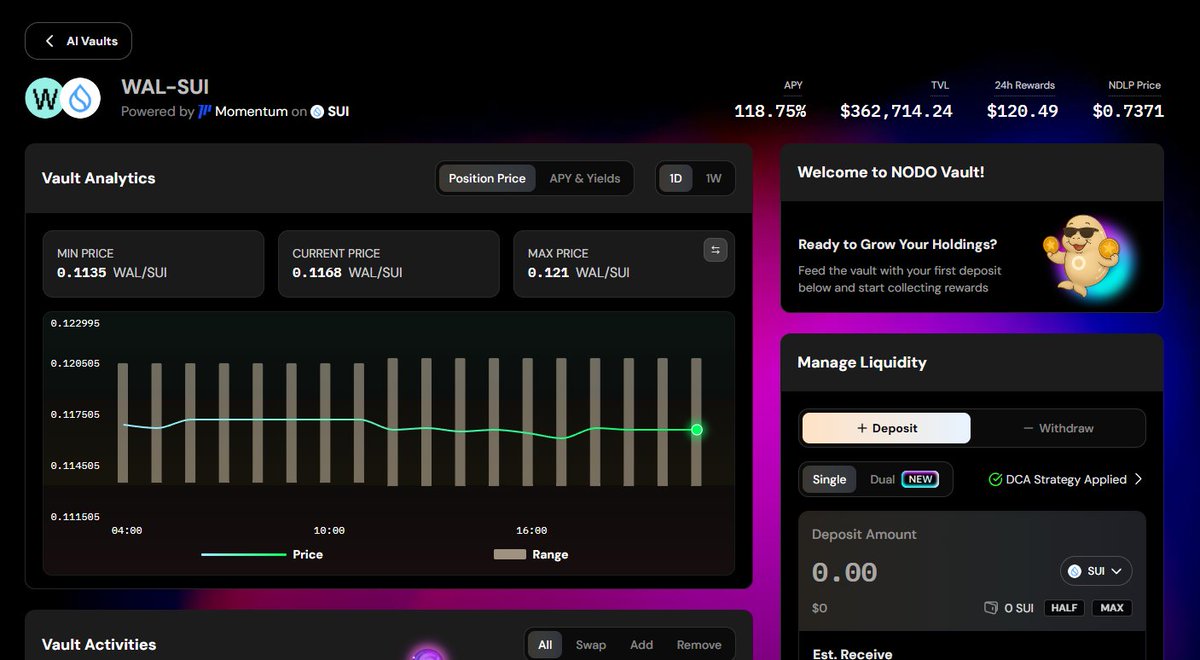

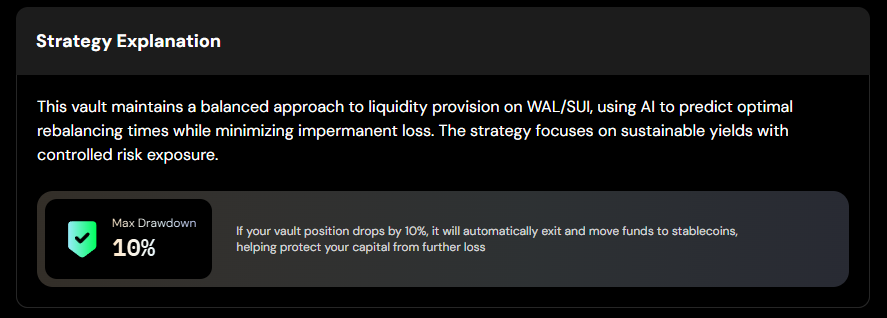

There are various providers, but @WalrusProtocol wants to operate LP based on the $WAL token, and if management is cumbersome, this can be done through Nodo. As a side note, one of the unique strategies here is that if the total amount differs by more than 10%, it withdraws the entire amount and converts it to stablecoin. Since it is tied to Walrus's WAL token and SUI token, it seems designed to address the increased risk of IL.

These Vault features are surprisingly interesting, so it might be worth taking a closer look at them one by one later.

Show original

3.18K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.