The strongest version of "BNB Micro Strategy" is here. I saw this news: CEA Industries, a publicly listed company in the US (stock code: $BNC), announced today that its BNB Network Company has invested $160 million to purchase 200,000 $BNB tokens, becoming the world's largest BNB corporate treasury. Previously, BNC completed a $500 million private placement led by X Capital and YZi Labs, aimed at building an asset reserve strategy centered around BNB.

Recently, BNC's leadership underwent a restructuring, with Galaxy Digital co-founder David Namdar appointed as CEO, and former CalPERS CIO Russell Read and former Kraken director Saad Naja also joining. The addition of top talent from the crypto industry means that the company's leadership can better support the development of BNB crypto-priority business.

Of course, BNC's establishment of the BNB treasury is also due to BNB being a deflationary token with continuous burning, the increasing activity on the BSC chain, and the expectations surrounding spot ETFs. The underlying asset logic remains very solid.

In addition to the previous $500 million from the private placement, BNC can also obtain an additional $750 million in financing through its warrant structure, bringing the total funds used to purchase BNB to $1.25 billion, which is quite a substantial amount.

As a BNB holder, it indeed seems possible to expect four-digit BNB prices.

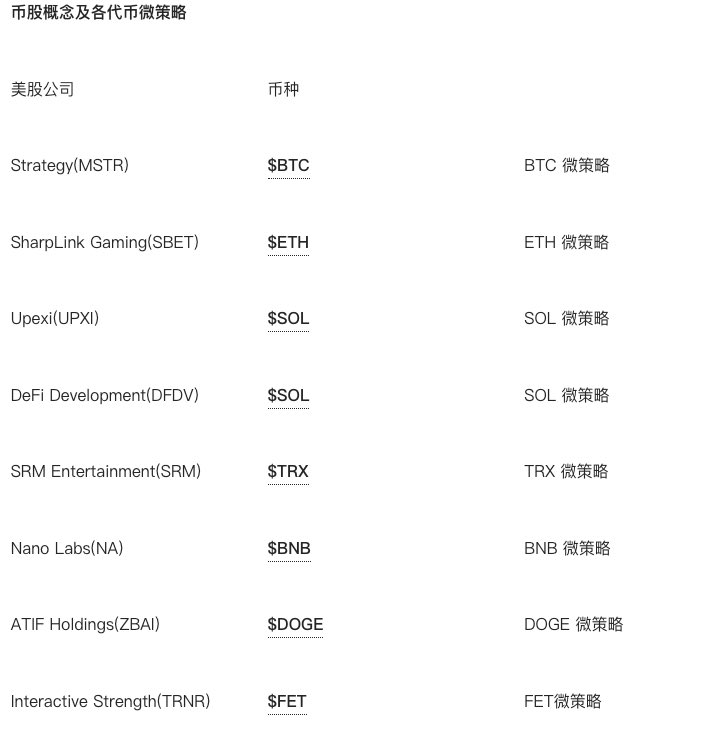

Token securitization is in full swing: after MSTR, ETH micro-strategy has the strongest momentum, and then SOL, BNB, TRX, Doge, Fet, hype, Tao, etc., which are not listed in the chart, have corresponding micro-strategy versions of U.S. stock listed companies.

32.39K

23

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.