🚨 Strategy’s Dividend Dilemma, TLDR @saylor has to hit the common stock atm if he isn't willing to sell any bitcoin.

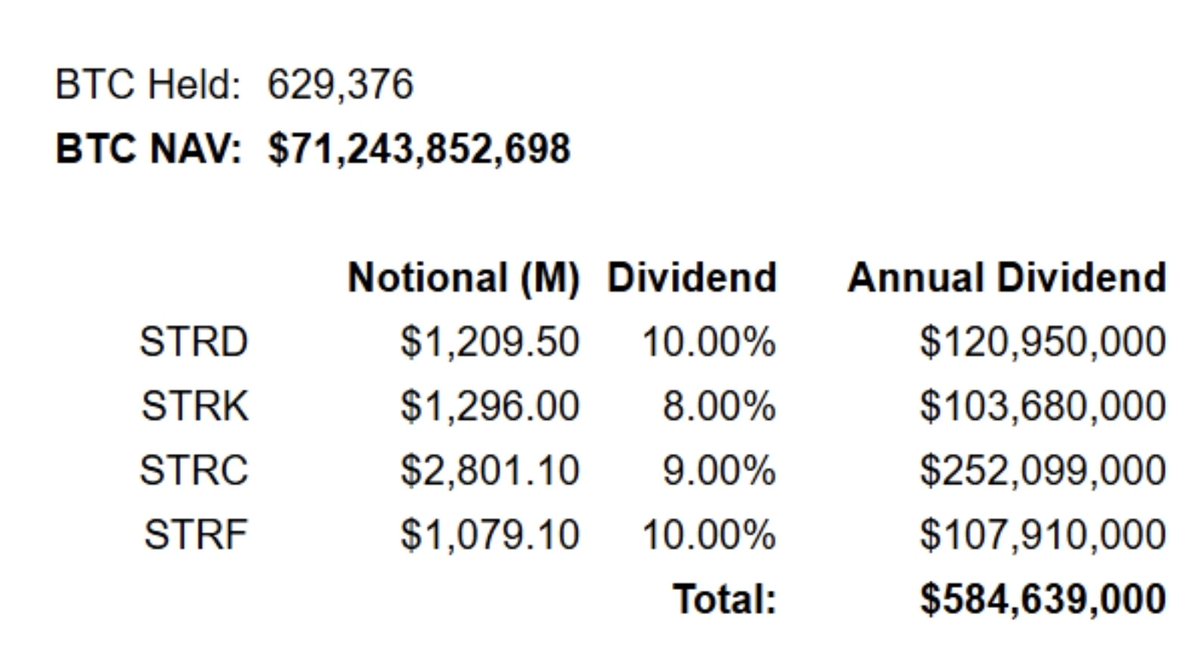

This chart shows $584.6M in annual preferred dividends owed:

STRD → $120.9M

STRK → $103.7M

STRC → $252.1M

STRF → $107.9M

Total ≈ $48.7M/month 💸

But here’s the problem:

Cash reserves ≈ $55M (aprox)

Ops cash flow ≈ $7M/month

Shortfall ≈ $40M+ every month

If ATMs shut down and no new capital comes in:

< 2 months before a liquidity crunch

Options:

1️⃣ Suspend dividends

2️⃣ Pay in stock (heavy dilution)

3️⃣ Sell or pledge BTC 😱

No ATMs = Bitcoin liquidation risk.

As @tomyoungjr first brought up, a SPAC funded by Strategy's bitcoin buys would trade,loan, pay dividends, which includes the sale of bitcoin.

8.4K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.