Here’s the @pudgypenguins situation and what’s going on right now🐧👀

- People borrowed ETH using their Penguins as collateral on Blur

- Blur loans are super risky → if liquidity disappears for 1 day, your NFT gets liquidated

- Right now, 150+ loans are at risk

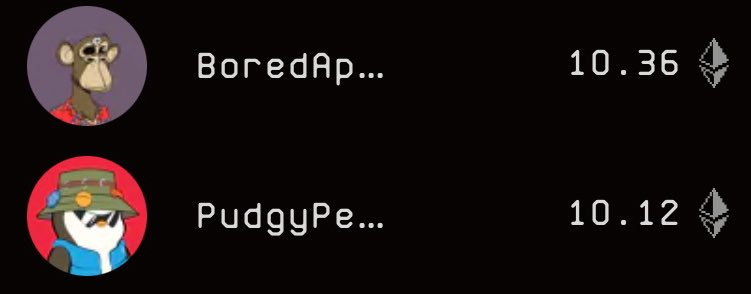

- 140+ Penguins could liquidate in the next 24hrs because the debt is now bigger than the floor price

- If that happens, borrowers lose their NFT, and lenders get stuck with Penguins instead of ETH

- Floor price is already down -16% today (~10.3e)

So who wins?

- Borrowers lose their Penguins

- Lenders get stuck with NFTs worth less than their loan

- Blur takes fees no matter what

It’s like pawning your car for $20K. If the car drops to $15K:

- You lose the car

- The pawn shop is stuck with a $15K car after giving you $20K

- But the shop still made money on fees

TLDR: 150+ Pudgy loans on Blur are underwater. Borrowers may lose Penguins, Lenders could get stuck, Blur always wins.

The only way out is to repay, refinance, or have liquidity to make the floor price go up ASAP 👀

19.93K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.