Prediction markets become the new battleground on Wall Street: Kalshi bets on compliance, Polymarket joins forces with NYSE

By Chloe, ChainCatcher

Last November, the FBI raided Shayne Coplan's New York apartment in connection with the involvement of election betting at the startup he founded, Polymarket.

In July, Polymarket acquired derivatives exchange QCX LLC (or QCEX) for $112 million, giving Polymarket a DCM license and allowing Polymarket to enter the U.S. market.

After the acquisition was completed, Polymarket waited for weeks until the CFTC issued a "No-Action Letter" in September this year, officially allowing the company to operate within a certain scope without being pursued by law enforcement. Less than a month later, on October 7, the New York Stock Exchange's parent company, Intercontinental Exchange (ICE), announced that it would invest up to $2 billion in Polymarket, a deal that valued Polymarket at $8 billion.

Almost at the same time, Polymarket's biggest competitor, Kalshi, also announced that it had completed a $300 million funding round at a valuation of $5 billion and plans to allow customers in more than 140 countries to bet on its website.

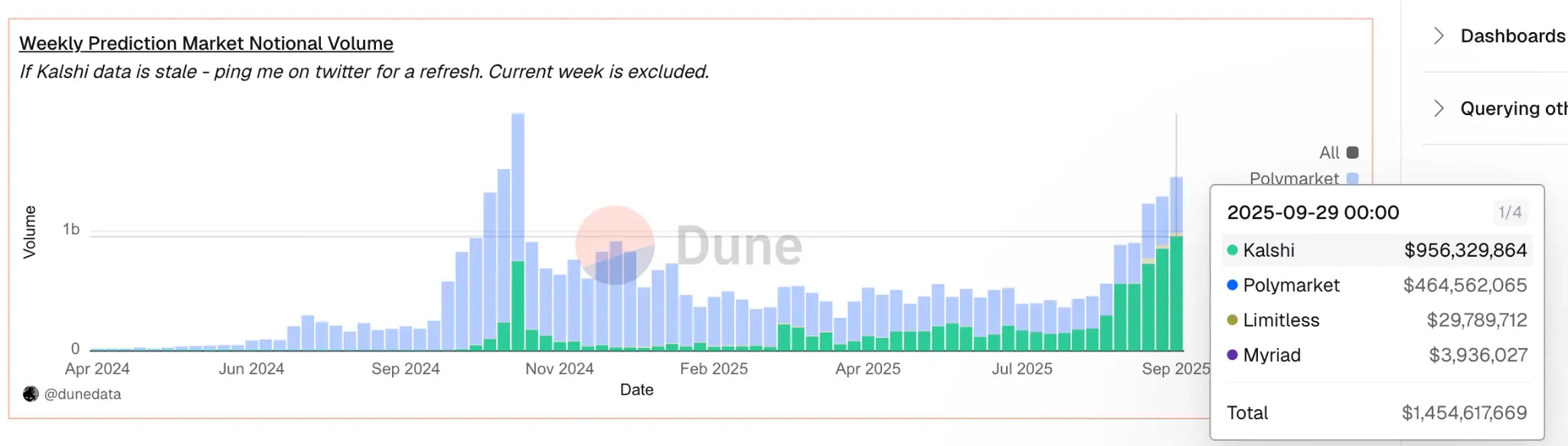

According to Dune Analytics, Kalshi recently overtook Polymarket to capture more than 60% of the global market share, and Kalshi's annual trading volume has grown to about $50 billion, up from about $300 million last year.

– >

– >

Both companies announced funding in the same week, highlighting that prediction market platforms have moved into mainstream market view, and that both Polymarket and Kalshi already have regulatory legitimacy and are now competing on the same starting point.

What is ICE's true intention?

First of all, ICE's choice to invest in Polymarket with $2 billion may have been laid out for a long time, and it is a step after many years of laying out blockchain and digital assets. The NYSE operator launched Bakkt back in 2018, offering Bitcoin custody and futures services, and has emphasized in various public forums that tokenization will be at the heart of the future market infrastructure.

CEO Jeffrey Sprecher publicly predicted in 2022 that digital assets will become the track for the value transfer of various assets. However, from entering Bitcoin futures to investing directly in a fully on-chain crypto-native platform, ICE has made this choice, highlighting that its vision has shifted from a single category of digital assets to a deeper "blockchain-native data infrastructure".

Polymarket's favor with ICE stems from its distinct operating model from other Web3 projects. Many platforms under the banner of decentralization still carry out core data and settlement in centralized servers, while Polymarket puts market operation, settlement, and transactions all on the chain.

Settled by smart contracts deployed on the Polygon chain, collateralized in USDC, and presented as a tokenized result. Users mint YES/NO tokens directly on-chain, which exist in wallets as ERC-20 assets and can be freely traded or exchanged at the end of the predicted event. The settlement process is handled by UMA Optimistic Oracle and in partnership with Chainlink to publish the results of asset price classes directly on-chain. This mode of operation is equivalent to making every transaction, every settlement, regardless of the outcome, form an immutable, transparent and auditable on-chain data.

For ICEs, Polymarket's value is not limited to prediction markets but to the vast and verifiable on-chain prediction data it generates.

Unlike traditional financial forecasts, which may be subject to centralized compilation and manipulation, Polymarket data is a true reflection of the price signals of market participants' collective expectations, and these signals are recorded on the public chain, which is globally accessible and cannot be manipulated by humans.

ICE plans to position itself as a "global distributor of Polymarket event-driven data," offering these real-time probabilities as sentiment indicators to institutional clients and as a new source of data for macroeconomic forecasting, risk modeling, and more.

Further, this on-chain data can also become the underlying asset of new financial products. For example, Polymarket can build a "tokenized index" based on a set of event probabilities, while ICE can issue derivatives based on it, similar to an "event-driven ETF", such as the probability curve that tracks the US presidential election, the Federal Reserve's interest rate decisions, and Bitcoin price movements.

Integrated into on-chain transparency and financial expertise products, it has the opportunity to become a new generation of institutional-grade asset allocation tools.

Polymarket's path to a U.S. return to close the gap with Kalshi

Polymarket's regulatory return to the market, with the acquisition of QCX LLC's DCM license, first employed a self-certification mechanism to handle the event market, allowing it to list new contracts without prior approval without objection from the CFTC.

In the past, Kalshi was the first CFTC-regulated prediction market where users could trade directly on the outcome of real-world events, not stocks affected by the event, not currencies that could fluctuate due to the news, but the events themselves.

This mechanism allows Kalshi to design new event contracts on his own, simply submitting contract design files to the CFTC without obtaining approval one by one beforehand. If the CFTC does not raise an objection during the review period, the contract can be listed for trading directly. The CFTC retains the power to review and suspend after the fact, but this "first review later" model greatly speeds up product development. This allows Kalshi to quickly launch events across events such as weather, economic data, political events, entertainment awards, and more, without having to go through lengthy approval processes every time.

Between 2022 and 2024, when Polymarket was fined and operated offshore, this regulatory framework was Kalshi's strongest moat.

With the acquisition of QCX LLC, Polymarket has obtained the exact same regulatory license and operating mechanism as Kalshi. It now also holds a DCM license, can also use a self-certification mechanism to list new contracts on its own without objection from the CFTC, and has obtained a no-objection letter from the CFTC, officially confirming that it can operate legally under this framework.

The significance of this transformation goes beyond the surface. In the first half of 2022-2024, the competition between Kalshi and Polymarket is not on the same track at all. Kalshi has a US license and can legally serve US users, while Polymarket can only do offshore business.

The competition was not on the same track. Kalshi's core strength comes from its impregnable compliance status, while Polymarket, despite its popularity among crypto-native users, has been unable to enter the US market due to regulatory restrictions. The situation is completely different now, both companies hold the same level of exchange licenses, use the same contract approval process, can develop new products at the same speed, and can enter the US market completely legally.

CryptoSlate, a crypto media outlet, noted: "Kalshi's compliance advantage once seemed indestructible. However, if Polymarket can operate under a similar CFTC framework while leveraging ICE's technology and data coverage, the gap between the two will begin to disappear. "

Polymarket and Kalshi are more like a showdown of business ideas,

Kalshi has adhered to the image and operating philosophy of a financial exchange since entering the market from the very beginning, rather than a cryptocurrency startup. It operates under the full oversight of the CFTC, clears transactions in US dollars, requires KYC verification, and positions its offerings as risk management tools rather than speculative bets.

Founders Tarek Mansour and Luana Lopes Lara often describe their goal as building a "futures exchange for everyday events." Rooted in traditional market structures, Kalshi emphasizes transparency and incremental growth, viewing compliance as its core competitive advantage. Expanding to 140 countries and with a growing list of macro and cultural markets, the company tries to build an impenetrable moat through regulatory certainty.

Polymarket's trajectory is quite different. It rose during the DeFi boom to become an open tokenization platform where users can trade on almost any topic using stablecoins. Its speed and openness make it highly popular among crypto-native users and political bettors, but its regulatory risks limit its access to mainstream capital.

When U.S. regulators fined Polymarket and restricted its operations in 2022, it seemed to confirm Kalshi's long-standing argument that compliance was the only way to scale. However, the ICE partnership could flip this narrative, proving that once trusted intermediaries build bridges, crypto-native models can coexist with regulatory legitimacy.

The result is convergence: Kalshi shifts slightly towards innovation, while Polymarket moves closer to regulation. Kalshi's compliance advantage once seemed indestructible. However, if Polymarket can operate under a similar CFTC framework, while leveraging ICE's technology and data coverage, as well as the unique value of transparent data on the chain, the gap between the two will gradually close.