Breaking down what "capital-efficiency" means on Drift

I've been trading in capital and crypto markets for nearly a decade, and the universal principles are all the same: to always be maximizing yield on holdings & minimizing your cost of capital.

Since day one, Drift's core focus has been building products that are capital-efficient and can generate sustainable wealth for our users. I want to dial in on what "capital efficiency" actually means:

1. Capital never sits idle

Drift automatically generates yield from its borrow/lend platform on your idle capital. When you use capital as collateral for trading, it still continues to earn yield.

Take syrupUSDC as an example: deposit it to trade perps and you'll continue earning ~12% APY even while holding your BTC long. It simply maximizes returns across the board. USDC earns you 8%+, which you can benefit from whether or not you're in a trade.

2. Cross-collateral flexibility

Drift is one of the few platforms in all of crypto offering any asset as collateral. Deposit any of the 40+ supported collaterals to trade in any perp market we offer.

If you're long-term bullish on SOL but want to trade BTC price movements on other platforms, you'd have to exit SOL → USDC → BTC, losing your SOL upside. On Drift, you stay exposed to SOL's potential while trading market swings across other (BTC) markets.

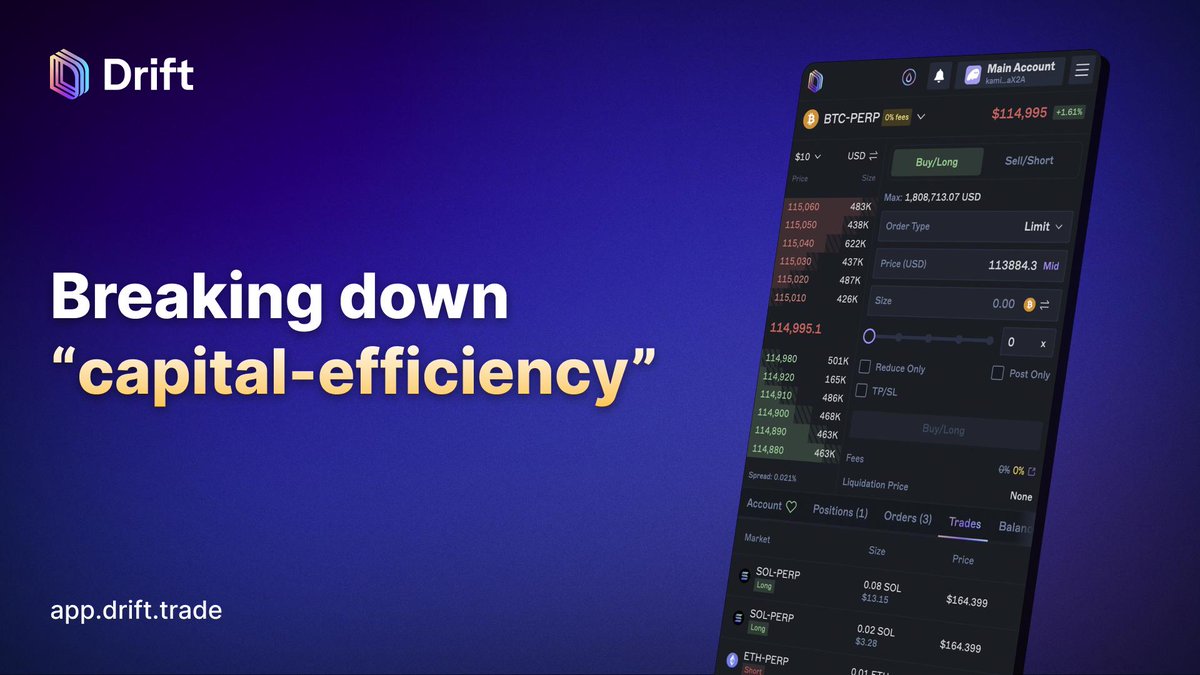

3. Zero-fee markets

Two of our leading markets, BTC and ETH are now zero fees!

A trader with just $1,000 can open $100k positions multiple times daily, trading millions in monthly volume on BTC/ETH markets, and would still pay $0 in fees.

4. Up to 101x leverage

We offer 101x leverage on our leading markets (SOL, ETH, BTC), giving traders flexibility to trade with massive conviction. Drift democratizes leverage for traders of all sizes -- you need less than $1,500 to trade 1 full Bitcoin on Drift.

5. Unique Trading Setups

There are many unique opportunities that are enabled by our capital-efficient market structure, such as arbitraging funding rates, running delta-neutral strategies, cross-platform lending, and looping strategies.

For instance, you can run a delta-neutral trade by just depositing spot BTC and short BTC-PERP against it, capturing a funding rate.

Our recent syrupUSDC listing with @maplefinance perfectly illustrates this, where traders are now using syrupUSDC as collateral across 50+ markets while accessing THREE yield sources:

- Underlying stablecoin yield

- Lending/borrowing yield on Drift

- Share of $100k incentive pool

This is our broader mission: unlocking capital-efficient, yield-accretive pathways for DeFi users onchain.

The Future

As competition increases, users win and innovation accelerates. The Drift team is heads-down building the best trader experience, building in public from the heart of capital markets' future - on @Solana.

- Cindy

Show original

8.7K

58

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.