Can stablecoins save @WesternUnion?

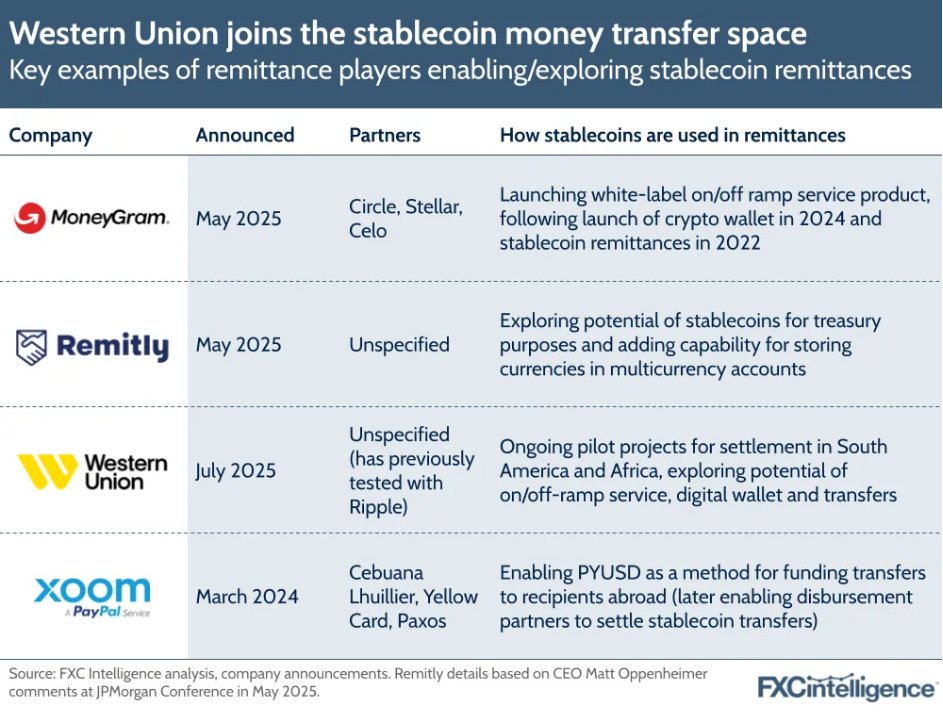

Their revenue is down 25% as digital players like @Wise and @remitly take share. While they're looking at stablecoins for treasury, that's not a unique edge as their rivals can do the same.

WU's real moat is its 400K global agent locations.

By leaning into this network, WU can become the indispensable cash-to-stablecoin bridge for millions of cash-reliant individuals AND for fintechs needing a white-label on/off-ramp to the physical world.

This buys them time against the decline of cash and gives them a foothold in its digitization. It's the wedge they need to build a wallet, bundle services, and truly bank the unbanked.

No, stablecoins won’t save yesterday’s remittance model. But they are the key to unlocking WU's future as critical infrastructure for the new digital economy.

Read the full breakdown in my latest article. Link in the comments. 👇

Show original

14.28K

116

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.