When the price is low, any bit of good news can ignite a fire that spreads like wildfire; the opposite is also true.

Attacks must be decisive, and defenses must be equally resolute. My attack period is from June 22 to now, and in the coming time, I will focus on defense; profits realized and not given back are true profits, while giving them back can only be called floating profits.

What the hell is PEPE, Dogecoin, shit, what XRP, LTC, BCH? I have no faith in these altcoins, only speculation.

Bitcoin rose from 15,000 to 120,000, experiencing three waves of pullbacks measured in months; but Ethereum is amazing, Ethereum won't, Ethereum will go straight to 100 million, let's go!

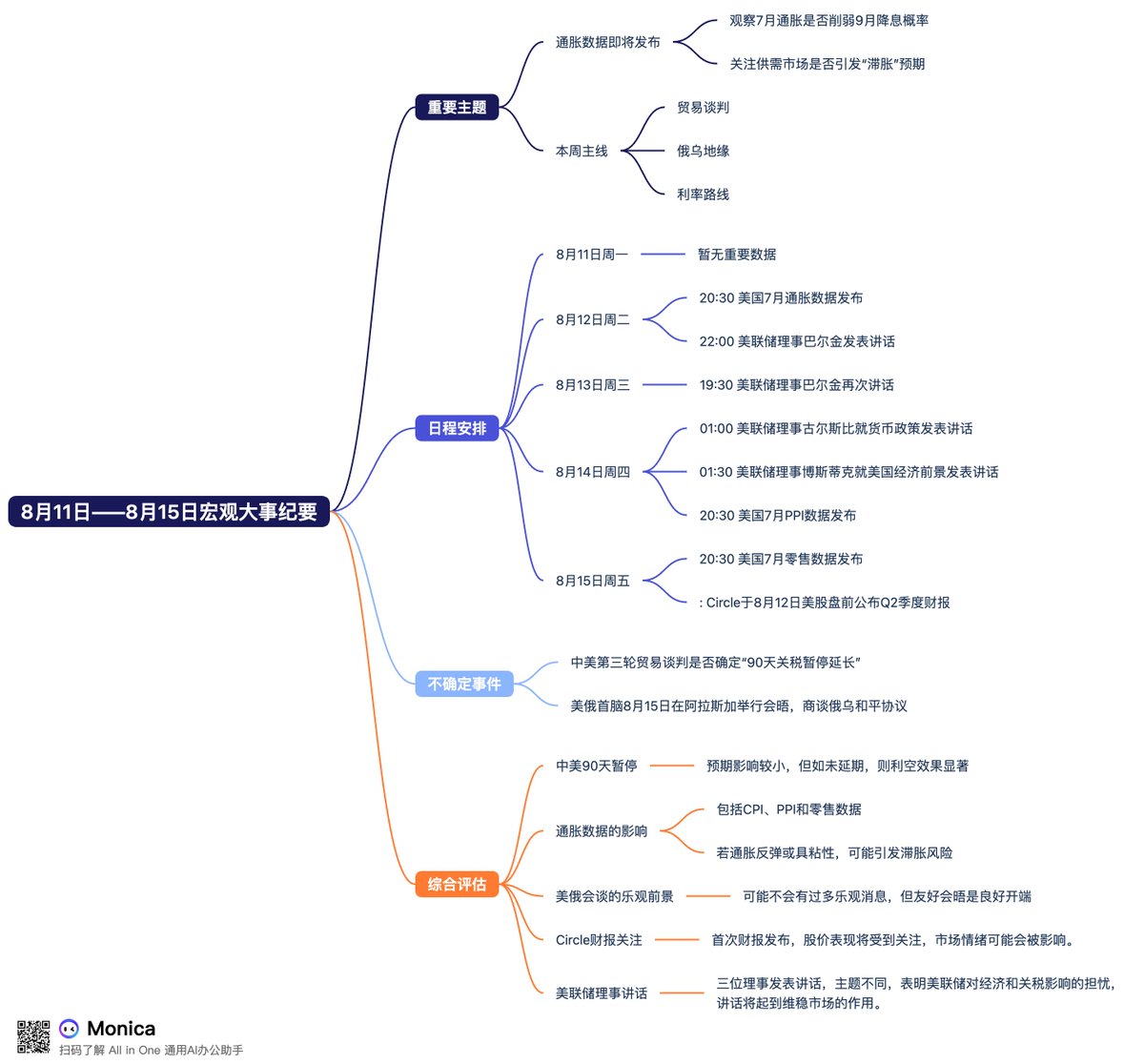

August 11 - August 15 Macro Event Summary:

Inflation data week is here, watching to see if July inflation will continue to weaken the probability of a rate cut in September! Also, whether the supply-demand market will trigger negative expectations of "stagflation"!

This week's main themes: trade negotiations, Russia-Ukraine geopolitics, interest rate trajectory.

Monday, August 11,

No important data

Tuesday, August 12,

20:30 US July inflation data

22:00 Federal Reserve Governor Barkin speaks

Wednesday, August 13,

19:30 Federal Reserve Governor Barkin speaks

Thursday, August 14,

01:00 Federal Reserve Governor Quarles speaks on monetary policy

01:30 Federal Reserve Governor Bostic speaks on the US economic outlook

20:30 US July PPI data

Friday, August 15,

20:30 US July retail data.

Earnings reports: Circle will release its Q2 earnings report before the US stock market opens on August 12, this Tuesday.

Uncertain events:

1. Will the third round of US-China trade negotiations confirm the "90-day tariff suspension extension"?

2. US and Russian leaders will meet on August 15, this Friday, in Alaska to discuss the Russia-Ukraine peace agreement.

Comprehensive assessment:

This week's macro events are relatively simplified, with the most significant impact being the 90-day suspension of US-China trade negotiations, followed by inflation data and the impact of Federal Reserve Governor speeches on the probability of a rate cut in September, and lastly the Russia-Ukraine peace talks.

1. The 90-day suspension between the US and China has a relatively small impact on the market, as it was anticipated in advance, but if it is ultimately not extended, the negative effect could be significant.

2. This week's inflation data is divided into three categories: comprehensive data CPI, supply-side PPI, and demand-side retail data. A comprehensive assessment as of July shows the impact of tariffs and the economy on inflation, especially considering that if inflation rebounds or remains sticky, and consumption declines significantly like Q2 GDP data, it may trigger stagflation risks.

3. I personally do not expect too much optimistic news from the talks between the US and Russian leaders; however, a friendly bilateral meeting could be an opportunity for a positive turning point.

4. Circle's earnings report is worth paying attention to, as it is the first earnings report since the stock's listing. Circle's initial public offering triggered market FOMO, and the stock price has been continuously declining, with the bubble gradually dissipating. Whether the earnings report will boost the stock price depends on this situation.

5. It is important to note that three Federal Reserve governors will still speak this week, each with different themes. The recent intensive speeches by Federal Reserve governors also indicate that the Fed is quite concerned about the current economic situation and the impact of tariffs, and their speeches will play a stabilizing role in the market.

On the other hand, due to Trump's attempts to control the Federal Reserve, these speeches can also indicate whether individuals are gradually choosing sides, such as Waller and Bowman.

61.33K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.