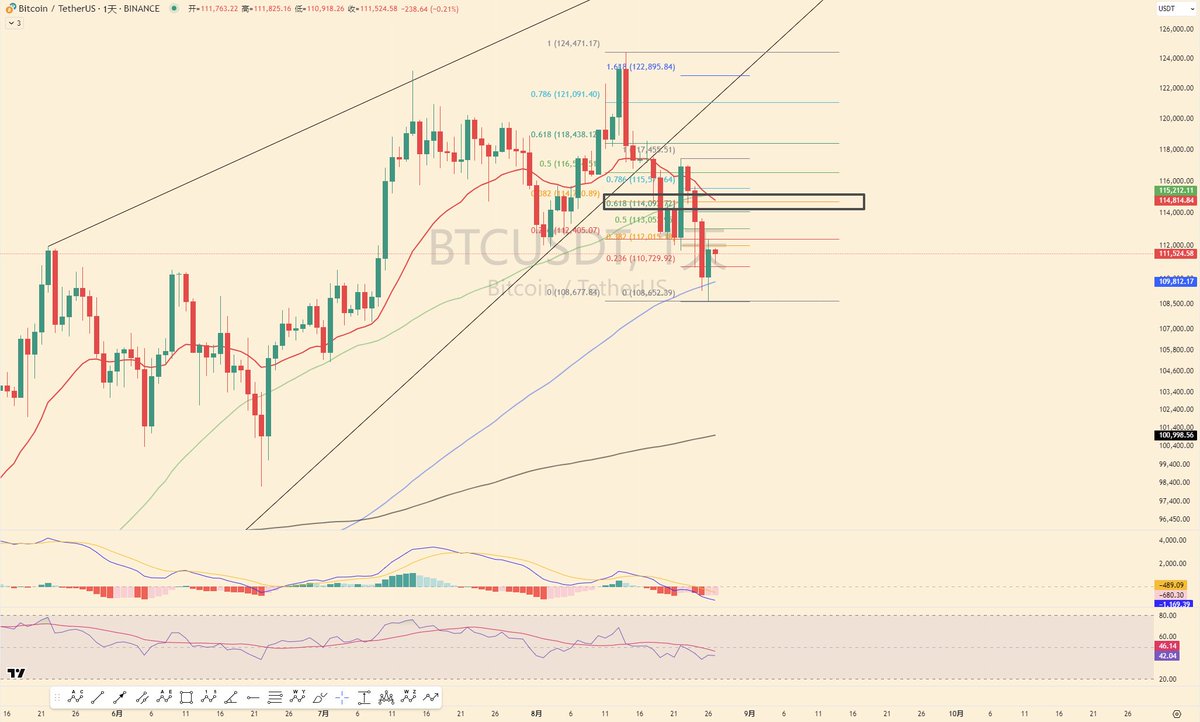

The big pie $BTC fell yesterday and touched the daily MA120 level for support, and is now in the process of rebounding.

Downtrends (adjustments) are relatively difficult to trade, as most form zigzag patterns, and key support levels are often confirmed repeatedly.

In a post a few days ago, I mentioned that the old bull-bear dividing line MA120 is almost a must-fight area.

At this position, we need to observe the strength of the rebound. If the rebound is strong, we can look forward to it; if the rebound is weak (sideways consolidation), then we need to be cautious.

The first resistance level is indicated by the black box in the chart.

1. $BTC Technical Analysis

The rise that started from 111920 is the final segment of the overall rise that began from 74508;

The current decline is nearing the point of consuming this last bit of the rise, and the level may have expanded to a correction targeting the rise from 74508 to 124474;

The rise from 74508 to 124474 may be the fifth segment of the overall rise that started from 15476;

So let's first assume a few key support levels and observe the price behavior when it reaches them, from near to far: 112000 (the starting point of the last segment), 108706 (today's price, daily MA120), 92503 (today's price, 3-day MA120), 74508 (the starting point of the ending diagonal).

Indicators:

The daily indicators for BTC are neutral, bearish below the daily level, and in a corrective process from a high position (overbought) above the daily level;

It is particularly important to note that if the daily bullish trend continues to weaken, the weekly MACD will form a death cross, which is a high certainty indicator at a larger scale. If the weekly death cross is confirmed, it will either be a long-term correction (from 2024-03 to 2024-08) or a violent drop (from 2025-01 to 2025-04).

2. $ETH Technical Analysis

ETH has been representative in the overall market trend that started on April 8, both in terms of the magnitude of the rise and in driving market sentiment; ETH has replaced BTC's position in this round.

The rise from 3354 can be seen as wave 3 of 5 or wave 5 of the rise that started from 1300 (uncertain);

Currently, the daily indicators are in a correction process, and the MACD has not returned to the 0 axis;

The larger scale is lagging behind BTC, and it is believed that it is still good to follow the market. If the market is good, ETH will perform better than the market, but if BTC drops, it cannot stand alone.

3. Others

Yesterday's decline was a resonance of the overall financial market; a few days ago, only the crypto market was down, while the US stock market had no reaction. Yesterday, both the US stock market and the crypto market fell together.

If the US stock market is not doing well, the crypto market cannot thrive independently. It should be noted that the main line of this round, the BTC and ETH ETFs, are all funded by big players in the US stock market.

1. The current overall adjustment has not accelerated; small-scale ups and downs are occurring, but looking at the daily closing, they are mostly solid bearish candles;

2. After scanning the macro pushes and policy pushes, I haven't seen any reason to rush towards 74000;

Currently, the market is in a phase where I am not very clear on what to do, so the strategy taken is to give up small opportunities and only grasp slightly larger opportunities that I can understand. After all, as Guillin once said, the larger the scale, the higher the stability;

One fact is that since April, we have already experienced over four months of rising.

76.55K

34

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.