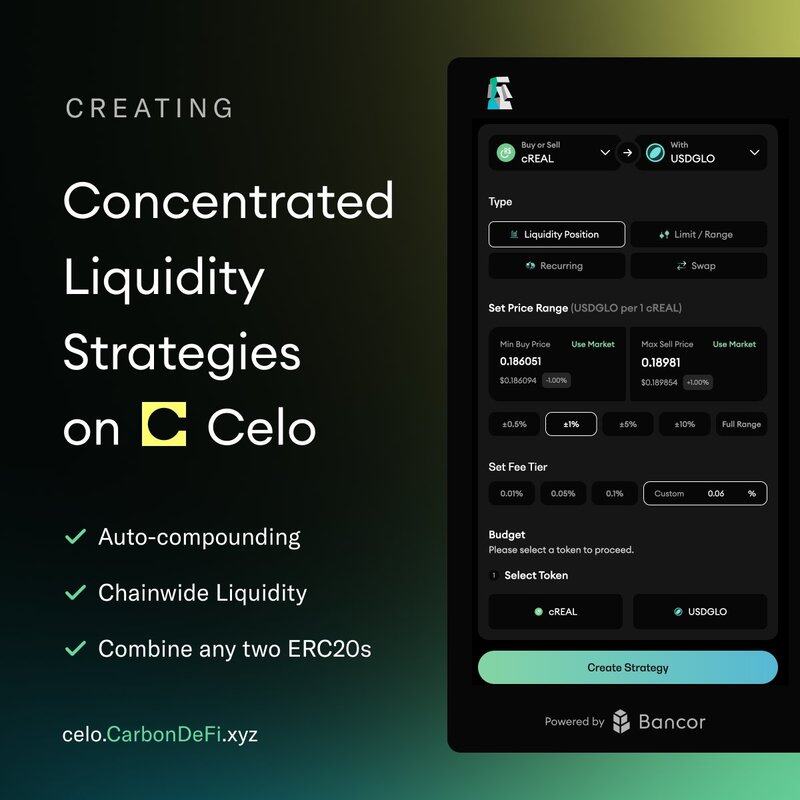

For those that have used concentrated liquidity DEXs, you are going to like Carbon even more as the fees automatically compounding.

In prototypical concentrated liquidity solutions, fees tend to collect in a separate bucket/location where you have to manually auto compound or rely on a third party. On Carbon DeFi, this happens automatically due to the internals of the protocol.

Furthermore, you have the option to set whatever fee (goodbye fee tiers) you want to charge the market to use your liquidity in addition to being able to create a concentrated liquidity position under ANY trading pair.

As long as the underlying tokens are sufficiently liquid onchain on any trading venue Bancor's Arb Fast Lane (and other takers) will source the liquidity chainwide and keep your position trading.

2.75K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.