I personally still think that the previous decline of Ethereum has little to do with the change of banks to accumulate funds, that is, the high profit is cashed out, and the old banker smashes the market to make a profit; During the same period, liquidity declined, and the overall market's ability to undertake various selling orders was weak. In addition to the recovery of market confidence brought about by the tariff policy after the end of early April, which will only improve + Laozhuang to do a new cycle + liquidity return, most of the subsequent upward trends are strongly related to the narrative buying confidence brought by micro-strategy currency stocks

Personal review~

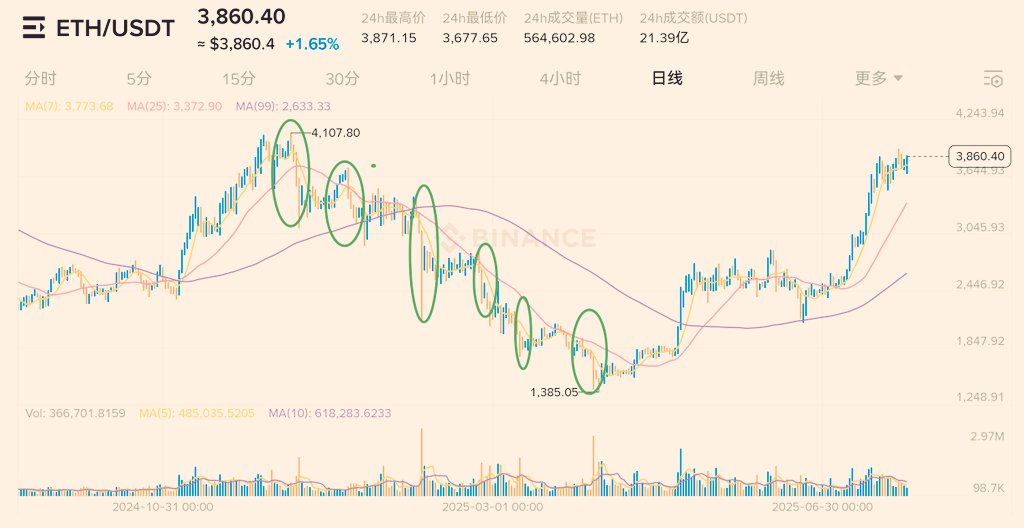

Ethereum's first wave of decline from the high of 4100 to the first pullback platform was followed by a rally, and discussions began to emerge about Ethereum changing hands and accumulating chips. By the time the second pullback platform arrived, such discussions gradually increased. As a result, the price continued to break down, and the talk of changing hands went from small to large and then back to small, turning into a situation where the market was abandoned by the whales. Meanwhile, old OGs kept leaving and cashing out, and the market's criticism grew louder, such as the later frenzy of dissing Vitalik.

Why was there talk of changing the main players to accumulate chips in the high market before? It wasn't until I accidentally came across a so-called "Ethereum 'chip concentration' fitting chart" while climbing the stairs recently that I thought, "So that's how it is." From the chart, it can be seen that since Ethereum's launch, whether it was a bull market skyrocketing hundreds of times or a bear market plummeting 95%, the so-called chip concentration trend has been consistently declining, until the end of 2024 when it started to show a turning point at 4000, and the chip concentration has been continuously increasing.

Interesting~

23.74K

42

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.