Architecting Stability in the App-Chain Era: The Role of Puffer UniFi AVS

If there’s one lesson that has stayed with me in this space, it’s a phrase from my @RubiksWeb3hub: “The best way to understand DeFi is to relate it to life.”

Human history is a story of movement not just of bodies, but of minds and ambitions. From the first wanderers who left their fires to cross deserts and oceans, to the innovators rebuilding fallen cities, we carry a quiet restlessness.

We move because we believe there is more opportunity, freedom, and alignment with our hopes. Yet every migration comes with a cost.

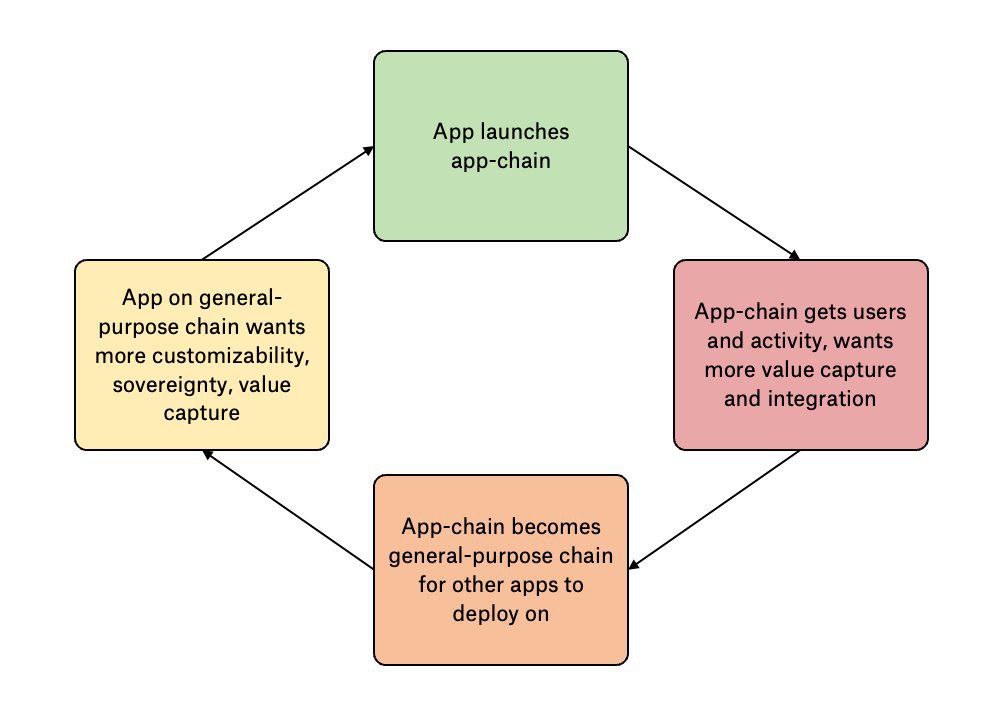

DeFi mirrors human psychology, where protocols are wanderers too. They launch where liquidity and incentives attract them, calling it home.

But as they find product–market fit and grow revenue, loyalty fades replaced by a search for better alignment, like tenants who, after finding success, become landlords.

A recent example of this is @GTE_XYZ raising over $25M and, as one of the fastest-growing ecosystems on MegaETH, setting out to scale from one to one hundred.

The logic is simple own your space, set your rules, and keep more of the value you create in other words, sovereignty.

This isn’t greed; it’s a natural progression. But when it rests on fragile foundations or is pushed to excess, it can shake the entire system. We saw it in 2008, when an unsustainable rush into property ownership, fueled by risky debt, brought the housing market and the global economy to its knees.

In DeFi, the parallel is liquidity fragmentation: protocols chasing sovereignty at the expense of the shared stability that once held the ecosystem together.

Technically, this is the push-and-pull between sovereignty and shared infrastructure. An appchain gives you control over execution, fees, and governance but often at the cost of liquidity, composability, and security that large shared layers like Ethereum provide.

Too much isolation, and the network effect that powers DeFi begins to weaken.

The solution isn’t to kill sovereignty, but to structure it better letting protocols own their economic value without cutting themselves off from the shared economy.

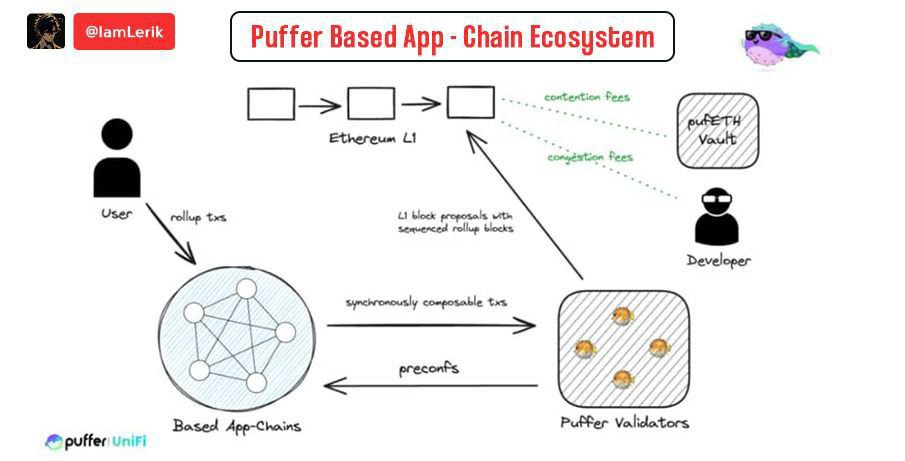

That’s where @puffer_unifi comes in: a solution built on @eigenlayer infrastructure, addressing the preconfirmation dilemma with a based rollup approach.

Instead of running a separate sequencer, it anchors sequencing to Ethereum itself, letting Ethereum own proposers, searchers, and builders include the rollup next block directly in the next Ethereum block. This preserves Ethereum liveness and decentralization while allowing the rollup to keep its own execution logic and fee model.

If you want sovereignty, two things matter: the cost of building your infrastructure and achieving PMF, because the success of an app is often tied to its chain.

This is why many projects launch on a shared chain with a great UX, and then migrate to an appchain to improve UX and own the economics Unichain being a key example.

With Puffer, you bypass the hardest parts. You benefit from Ethereum security and composability, avoid fragmentation, and get easy deployment with a low barrier to entry.

Ethereum validation steps in through AVS with your setup, connecting you to a broad ecosystem, so you can focus on UX and PMF while worrying less about infrastructure and still gain economic alignment.

The more this is discussed, the clearer it becomes that Puffer growth is just beginning. They’re launching with multiple partnerships to keep the momentum going.

Enough for the wait welcome to Ethereum Based Appchains future @puffer_unifi, @puffer_unifiavs

Show original

14.34K

79

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.