After this update, Kaito has almost all of Bee Brother's project rankings moved up.

Especially @arbitrum, which has never made the list before, surprisingly ranked 61st this week. Although I'm not quite sure how this algorithm works, it certainly affirms Bee Brother's recognition of Arbitrum.

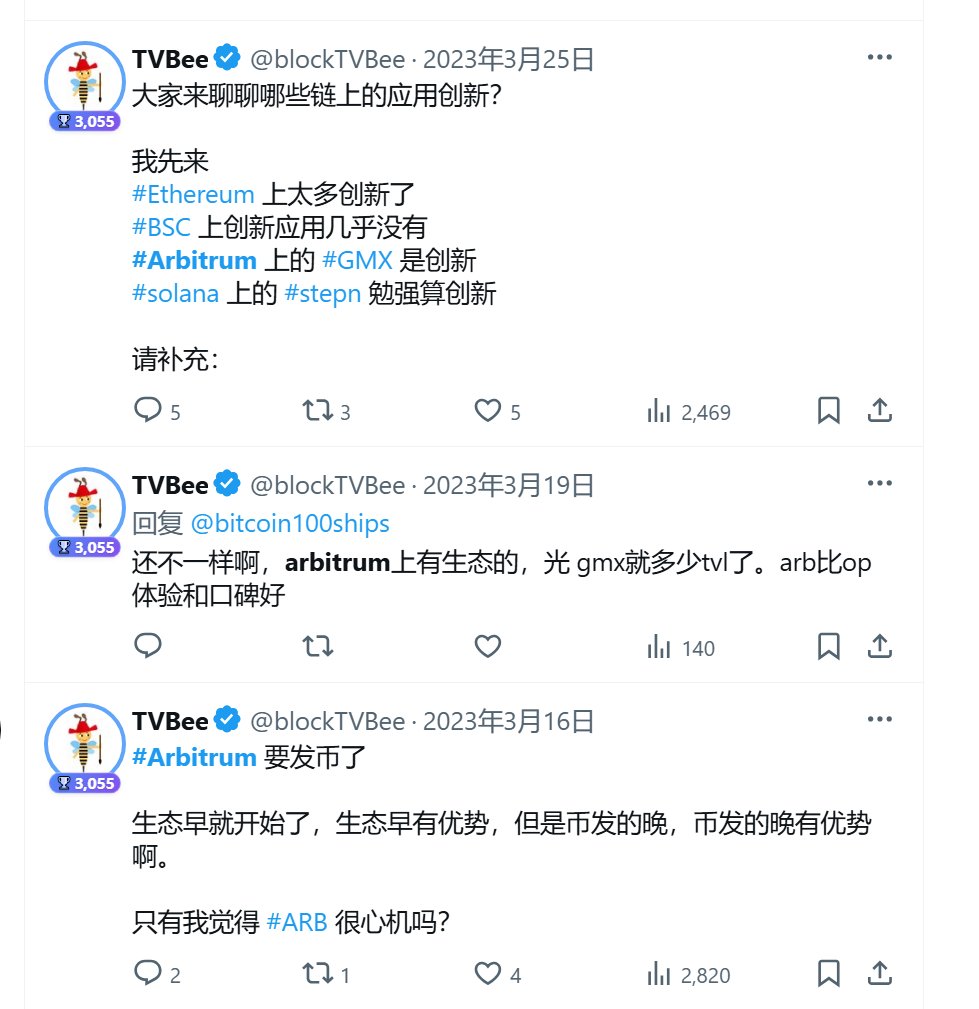

In fact, Bee Brother has always been paying attention to and appreciating Arbitrum. One could say that compiling all the content Bee Brother has written about Arbitrum would result in a long article:

First, in terms of operations, Arbitrum is quite strategic. Arbitrum seized the opportunity right from the start of its token issuance.

Secondly, in terms of ecosystem, Arbitrum has been relatively ahead almost all the time.

Bee Brother greatly appreciates GMX's innovation in its model. The BTC ecosystem's Sotoshi, which I encountered later, and MYX, which has recently skyrocketed, are both perpetual futures DEXs based on GMX's model. Of course, MYX has made significant innovations on this basis.

Today, $GMX also saw a significant price increase. GMX's choice to launch on Arbitrum itself is a recognition of Arbitrum.

Arbitrum's leading advantage in DeFi is widely acknowledged. This can also be reflected in the data.

Since the beginning of this year, according to debridge cross-chain data, Arbitrum has consistently seen net capital inflows.

Even the traditional American financial platform Robinhood launched ARB in March this year and used Arbitrum's technology stack to launch Robinhood's ecosystem chain.

To be honest, in 2022, Bee Brother had a job where the company connected with some projects for operation, and I was responsible for writing white papers for those projects. I don't know if those projects will eventually materialize, but they all claimed to be on Arbitrum. Up until 2024, most of the various projects I have encountered are also on Arbitrum, and I often use Arbitrum for transfers.

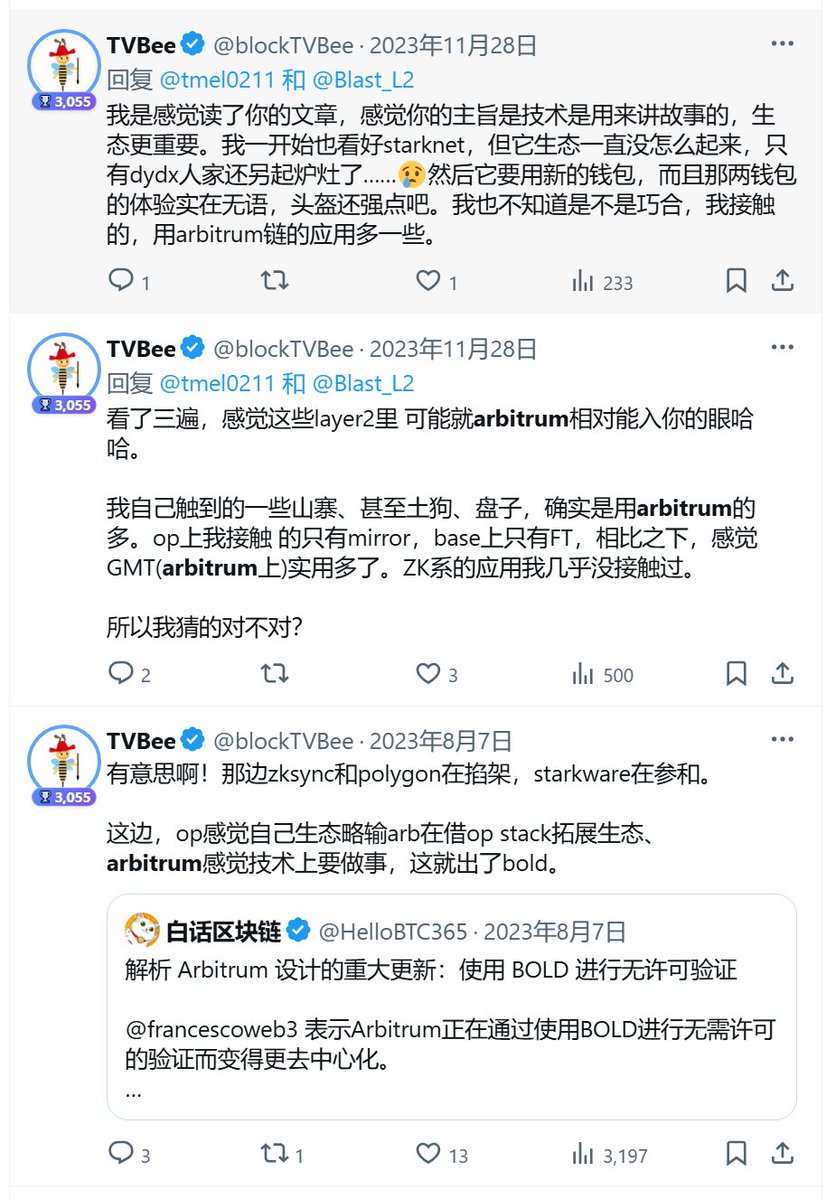

Third, in terms of technology, Arbitrum is also not lacking.

In 2023, there was a time when ZKSync and Polygon had a dispute over code borrowing, and StartNet also got involved. Perhaps because it was unrelated to ZK, Arbitrum continued to focus on its own technology.

By the end of 2023, inscriptions exploded. Various chains, including the Ethereum mainnet and layer 2, also began to inscribe. The result was that ZKS couldn't withstand the pressure, while Arbitrum's technology performed well under the pressure of inscriptions.

To put it this way, four images are not enough to capture all the tweets Bee Brother has written about Arbitrum over the years.

I forgot to mention, $ARB has performed quite well this year, almost doubling from April to now.

4.93K

68

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.